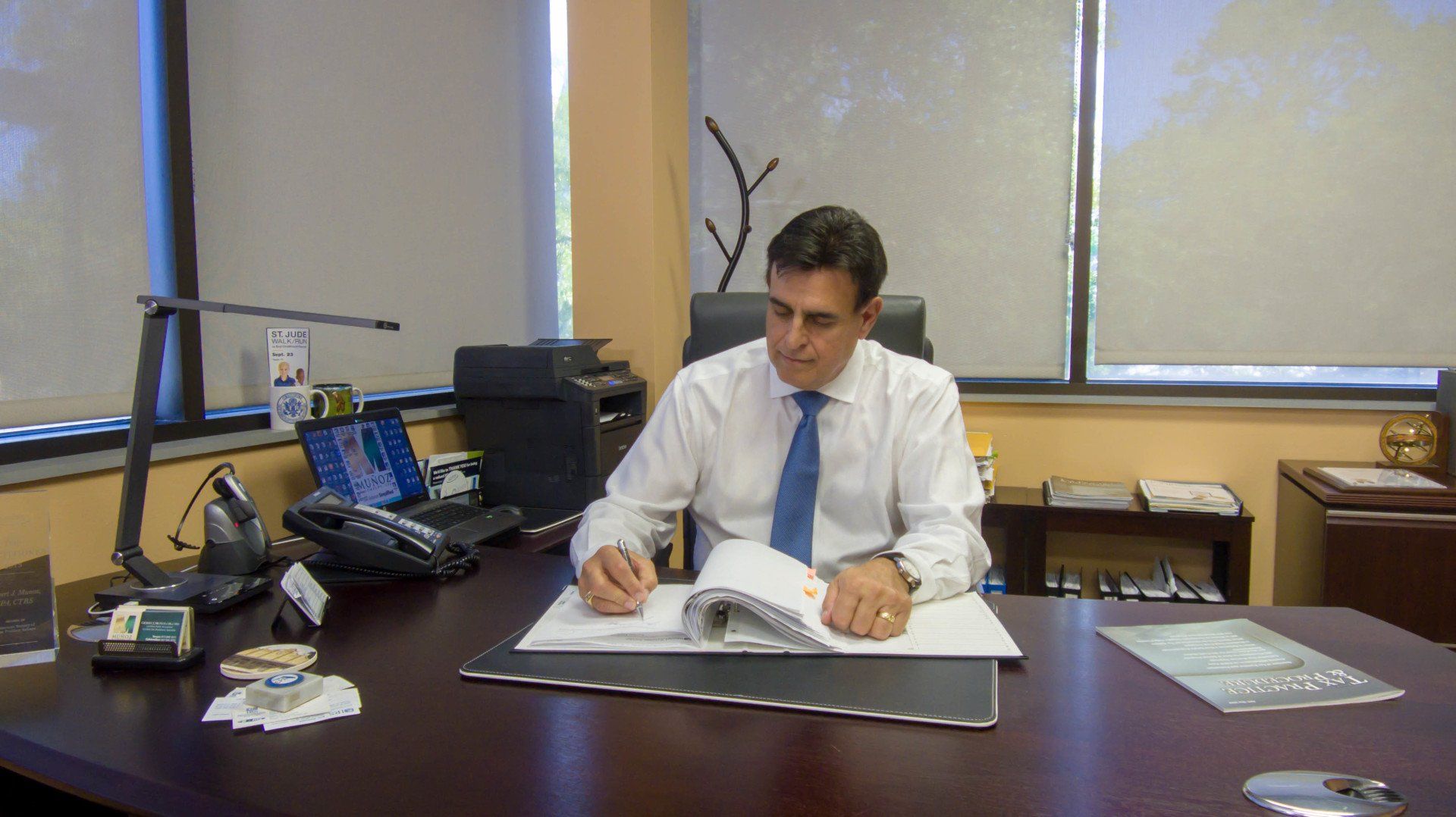

If you have foreign bank accounts, it’s important to file what’s known as an IRS FBAR, or foreign bank account reporting form, in order to avoid getting hit with penalties on your annual tax return. In and around Tampa, you can count on Munoz & Company, CPA, for assistance with FBAR filing and much more. Not sure how to go about reporting foreign bank accounts in the first place? I’ll walk you through the process. I’m your licensed and insured source for tax help in the region, and I care about giving you superior customer service. Contact me via phone or e-mail today to learn more!

Foreign Bank Account Reporting

When do you have to file a report of foreign bank and financial accounts?

- You’re a U.S. citizen, resident, or entity such as a corporation or LLC.

- You have a financial interest in or signature authority over at least one financial account located outside of the U.S.

- The aggregate value of all foreign accounts exceeded $10,000 at any time during the calendar year.

If all three of the above statements apply to your situation, foreign account reporting is a must. These accounts might include bank accounts, brokerage accounts, mutual funds, and trusts.

Even if you’ve filed a report of foreign bank and financial accounts in the past, you might need professional assistance handling it this year. The IRS has recently made some changes that have streamlined FBAR filing procedures, especially for delinquent reports. The new FBAR reporting process makes it easier to file both amended and delinquent returns, as well as to resolve FBAR penalties. You may be eligible for this new FBAR submission format if:

- You certify that your failure to report income was not willful.

- You are not currently under civil or criminal examination by the IRS for any taxable year.

- You pay off any previous penalties related to foreign bank account reporting.

- You have a valid taxpayer identification number (TIN).

Munoz & Company, CPA, will help you determine your eligibility and take you through the FBAR reporting process in order to ensure accuracy. Two key ways to avoid an FBAR penalty are to meet all IRS deadlines and to be certain that you’re reporting the right amount of international income. My job is to help you do just that. Meanwhile, if you know that you’ve already failed to meet FBAR filing requirements, I can help you minimize the fallout. I care about helping my clients achieve financial well-being and compliance with the tax authorities’ demands.

Learn more about FBAR filing requirements and get a free cost estimate for my expert services by calling now!