Under the best of circumstances, running a small business can be fraught with plenty of challenges and problems. The businesses that tough it out are the ones that have learned to consult specialists when the situation calls for it. If you find yourself at odds with a state or federal taxing authority, for example, that is absolutely the time to bring in a seasoned and proactive business tax consultant.

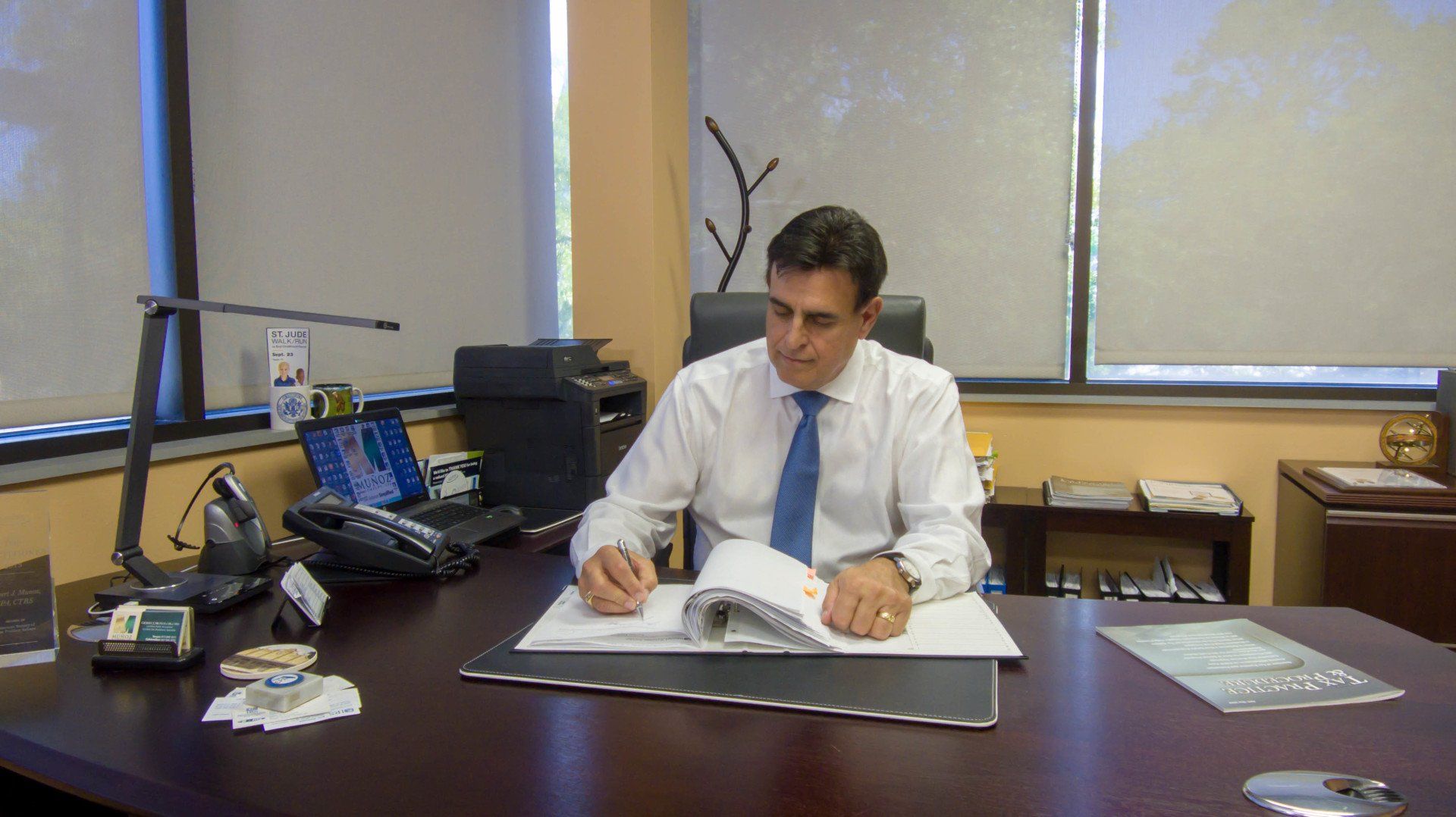

Owned and operated by Gilbert J. Munoz, Munoz & Company, CPA, brings more than 30 years of corporate tax resolution experience to the table and can help you and your business sort out virtually all kinds of small business tax problems. Whether your tax problems relate to the payment of back taxes, tax penalties, or issues stemming from an error in your taxes, I can work with you to find a solution. After examining your relevant financial records and pinpointing the problem, I will advise you on the best strategies for resolving your small business tax problems.

In tax resolution situations, my initial consultation is free, and I charge a reasonable flat fee to work with you and the state or federal taxing authority to implement a solution. When you need business tax help, one thing you don’t want to worry about is the cost of a tax consultant’s fee. When you hire Munoz & Company, CPA, to help you resolve your corporate tax or small business tax problems, you have the peace of mind of knowing that you’ll be charged a reasonable flat fee that doesn’t steadily increase with every hour I spend on your case. Other reasons for putting your trust and confidence in my tax advisory services are my high ethical standards, record of success in business tax resolutions, and three decades of solid experience helping businesses in the Tampa, Florida, area and beyond.

Payroll Tax Resolution Services

Falling behind in payroll taxes can result in steep penalties and other government actions that can adversely impact the viability of your business. Whether your payments are seriously behind or you’ve miscalculated state unemployment taxes or federal payroll taxes, I can help you iron out these payroll tax problems and bring about a favorable tax resolution outcome. You can count on me for guidance and representation when you need help with these related tax problems:

- Tax audit representation

- Penalty abatement

- Unfiled returns

- Liens, levies, and garnishments

- Errors or omissions with payroll taxes

- Other small business or corporate tax problems

Licensed since 1982, I’ve been helping small companies with business tax resolutions that enable you to work out a mutually satisfactory agreement with the appropriate government agency. My services allow you to put the tax problem behind you and move ahead with your business. E-mail or call me today for a quick response and fast, effective business tax help.